List of Unsold Condo Units in Singapore 2023

To date, there are only 7,214 unsold condo units (including ECs) in Singapore.

Due to the robust en bloc sales that took place between 2017 till the 1st half of 2018, homebuyers and investors will likely be overwhelmed by the huge number of new launch (or uncompleted) projects that are available in the market right now.

However, a huge portion of the supply has been absorbed by the market since late 2020.

According to the Urban Redevelopment Authority (URA) of Singapore, the total number of uncompleted private homes (excluding executive condos) in the pipeline works out to be a whopping 46,041 by the end of Q4 2022.

In Q3 2022, the number was 49,384 – which means 3,343 uncompleted homes have been added to the impending supply.

The encouraging part is that the take-up rates are growing as fast, if not faster than the supply piling up.

By the end of Q4 2022, the number of unsold condo units tallies up to only 16,024 – which is up from the 15,677 units recorded in the previous quarter.

In short, only 347 units were added within a span of 3 months. Honestly. that’s not a lot.

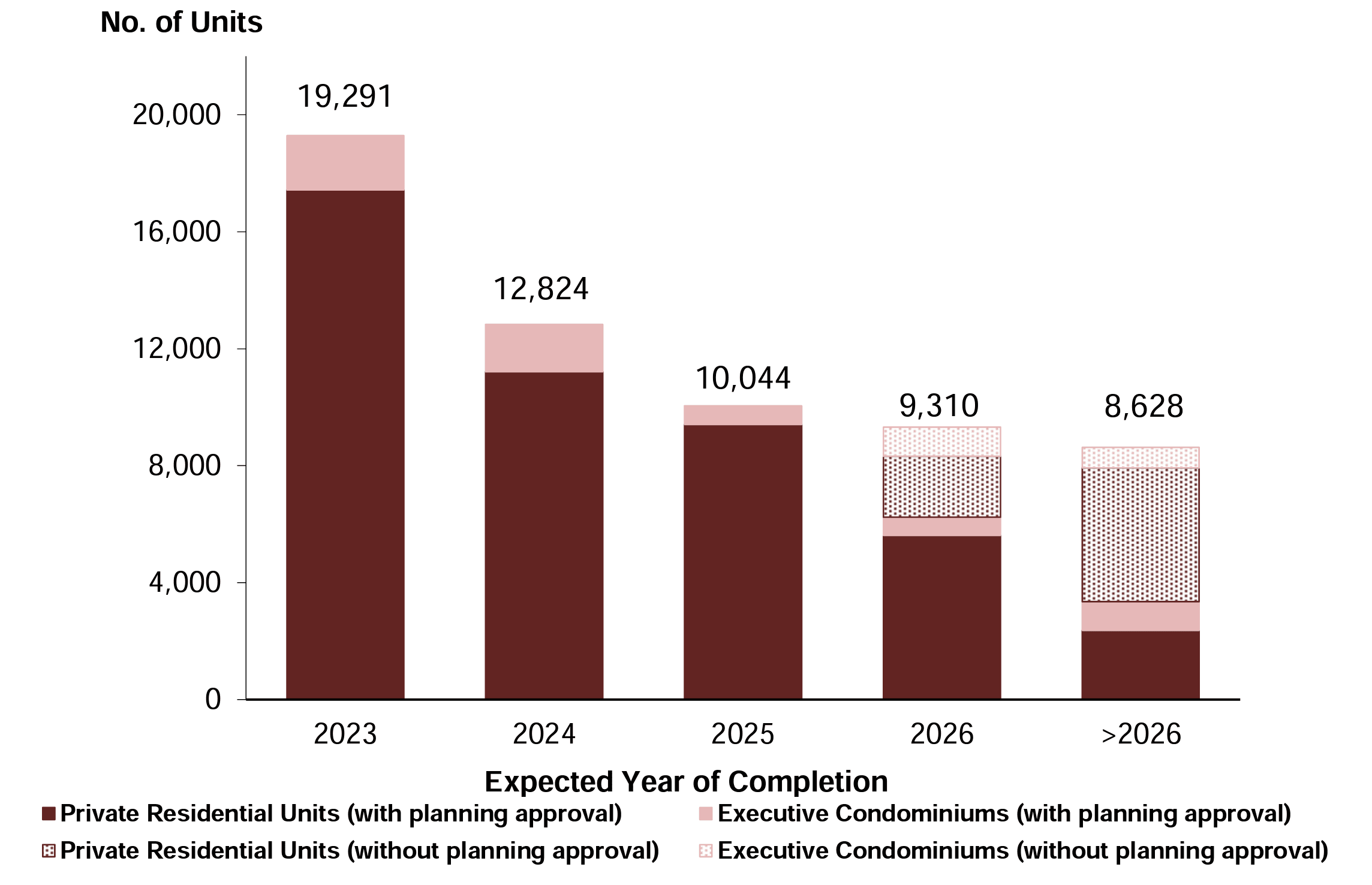

If you were to include the number of unsold executive condo units as well, here’s how the supply numbers will look for the next couple of years.

| Expected Year of Completion |

Private Residential Units |

Executive Condominiums |

Total Units |

| 2023 | 17,427 | 1,864 | 19,291 |

| 2024 | 11,215 | 1,609 | 12,824 |

| 2025 | 9,405 | 639 | 10,044 |

| 2026 | 7,702 | 1,608 | 9,310 |

| > 2026 | 6,952 | 1,676 | 8,628 |

| Total | 47,715 | 4,718 | 56,803 |

Learning from historical trends

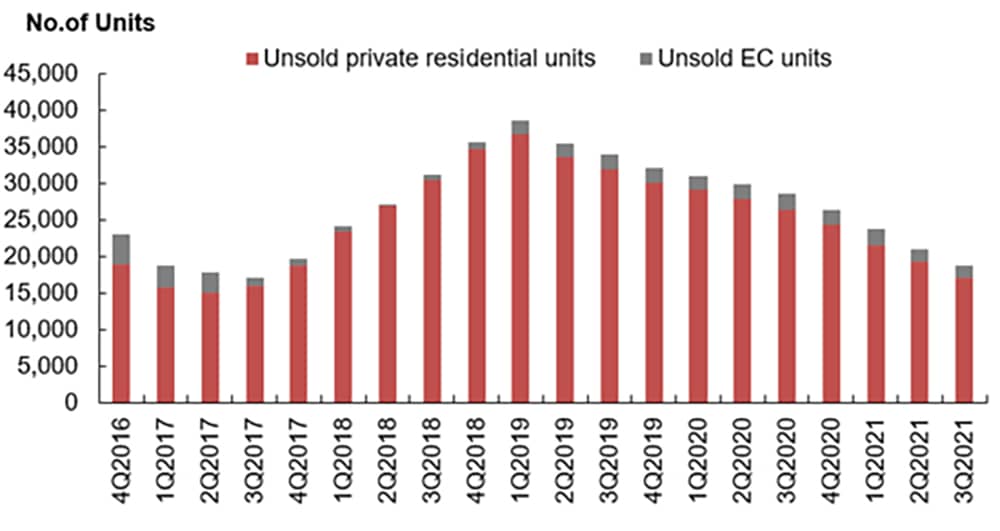

In case you are wondering why was there a ‘craze’ in the collective sale market and the period when homebuyers and investors were on a buying spree, here’s a chart from URA showing the total number of unsold condo units since 2Q 2014.

The supply of private homes and ECs was at the lowest point from the start of 2017.

As a result, developers were heavily bulking up their land banks with multiple land acquisitions between 2017 to 2018.

However, the government has put a stop to this frenzy by introducing a new round of property cooling measures back in July 2018 and reducing the land supply in the latest government land sales (GLS) programme.

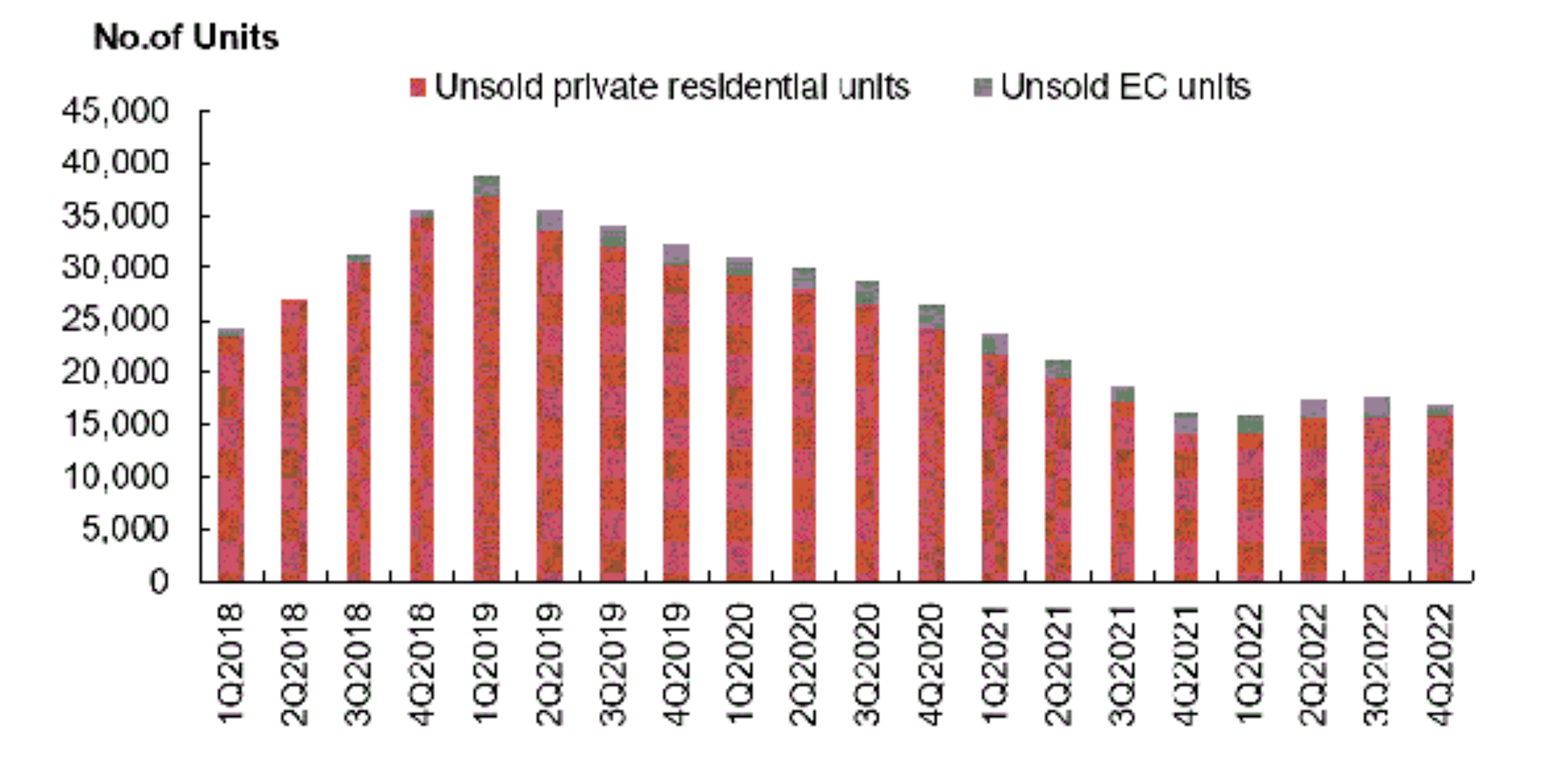

Let’s look at the latest chart provided by URA.

Thus, over the last couple of years, we saw a repeat of 2014 – 2016 when the property market was filled with unsold condo units.

That was actually the time period when developers were very conservative with their price points and dared not make significant price increments.

Obviously, that was perhaps the best time for buyers to enter the market before the next uptrend (when the housing supply runs low again), which technically is the current market situation.

Based on the rightful trend, we should have seen a huge influx of land sales and en bloc sales between 2021 and 2022.

It did look like we would repeat the 2017 – 2018 frenzy until the Singapore government stepped in with property cooling measures in Dec 2021.

Otherwise, we would be seeing many more unsold condo units projected for 2023 and 2024.

And when supply is heading south and demand is heading north, it’s natural to trigger more buying interest at this point of the trend.

Hence, now is possibly the best time (or even the last chance) to hedge onto the next upcycle by tapping on developers’ old stock of unsold condo units in Singapore.

The list of unsold condo units in Singapore

With an impending surge of new private homes in Singapore this year, I’ve prepared a list of unsold condo units in Singapore for 2023, which will be updated monthly.

I believe this will help you to source the best deal during this property-buying spree.

Instead of looking at the full list of unsold condo units in Singapore (updated on 25 Oct 2023), I’ve broken it down into 3 different regions or localities:

- Core Central Region or CCR (downtown central and high-end districts)

- Rest of Core Central Region or RCR (city fringe locations)

- Outside Central Region or OCR (mainly mass-market and suburban areas)

The list consists of developer sales for the whole of September 2023. It is sorted according to the number of units sold within the latest month.

I guess it’s a good indication of the popularity of each of the condo projects and what homebuyers and property investors are paying for.

Unsold Condo Units in CCR

| Project Name | Street Name | Total No. of Units | Sales for Sep 23 | Total Unsold Units |

Average Price (PSF)* |

| PULLMAN RESIDENCES NEWTON | DUNEARN ROAD | 340 | 21 | 10 | $3,258 |

| MIDTOWN MODERN | TAN QUEE LAN STREET | 558 | 9 | 27 | $3,061 |

| ONE BERNAM | BERNAM STREET | 351 | 9 | 144 | $2,584 |

| KLIMT CAIRNHILL | CAIRNHILL ROAD | 138 | 6 | 58 | $3,388 |

| LEEDON GREEN | LEEDON HEIGHTS | 638 | 6 | 13 | $2,774 |

| ORCHARD SOPHIA | SOPHIA ROAD | 78 | 5 | 49 | $2,826 |

| PARK NOVA | TOMLINSON ROAD | 54 | 4 | 1 | $3,441 |

| THE M | MIDDLE ROAD | 522 | 4 | 7 | $2,928 |

| ENCHANTÉ | EVELYN ROAD | 25 | 2 | 16 | $2,840 |

| IRWELL HILL RESIDENCES | IRWELL HILL | 540 | 2 | 3 | $2,651 |

| BOULEVARD 88 | ORCHARD BOULEVARD | 154 | 1 | 14 | $3,763 |

| DALVEY HAUS | DALVEY ROAD | 17 | 1 | 5 | $3,235 |

| GRANGE 1866 | GRANGE ROAD | 60 | 1 | 27 | $3,062 |

| JERVOIS PRIVE | JERVOIS ROAD | 43 | 1 | 28 | $3,203 |

| KOPAR AT NEWTON | MAKEWAY AVENUE | 378 | 1 | 6 | $2,874 |

| MIDTOWN BAY | BEACH ROAD | 219 | 1 | 98 | $4,086 |

| NEU AT NOVENA | MOULMEIN RISE | 87 | 1 | 0 | $2,559 |

| PERFECT TEN | BUKIT TIMAH ROAD | 230 | 1 | 6 | $3,501 |

| 10 EVELYN | EVELYN ROAD | 56 | 0 | 30 | – |

| 15 HOLLAND HILL | HOLLAND HILL | 57 | 0 | 0 | – |

| 19 NASSIM | NASSIM HILL | 101 | 0 | 95 | – |

| 35 GILSTEAD | GILSTEAD ROAD | 70 | 0 | 0 | – |

| ASPEN LINQ | INSTITUTION HILL | 18 | 0 | 1 | – |

| BOTANIC @ CLUNY PARK | CLUNY PARK ROAD | 6 | 0 | 3 | – |

| CAIRNHILL 16 | CAIRNHILL RISE | 39 | 0 | 0 | – |

| CUSCADEN RESERVE | CUSCADEN ROAD | 192 | 0 | 181 | – |

| HAUS ON HANDY | HANDY ROAD | 188 | 0 | 0 | – |

| HILL HOUSE | INSTITUTION HILL | 72 | 0 | 55 | – |

| HYLL ON HOLLAND | HOLLAND ROAD | 319 | 0 | 0 | – |

| IKIGAI | SHREWSBURY ROAD | 16 | 0 | 6 | – |

| JERVOIS MANSION | JERVOIS CLOSE | 130 | 0 | 26 | – |

| LANDED HOUSING DEVELOPMENT | MOUNT ROSIE ROAD | 6 | 0 | 4 | – |

| LANDED HOUSING DEVELOPMENT | BO SENG AVENUE | 6 | 0 | 2 | – |

| LES MAISONS NASSIM | NASSIM ROAD | 14 | 0 | 0 | – |

| NEWPORT RESIDENCES | ANSON ROAD | 246 | 0 | 246 | – |

| ONE HOLLAND VILLAGE RESIDENCES | HOLLAND VILLAGE WAY | 296 | 0 | 0 | – |

| PARKSUITES | HOLLAND GROVE ROAD | 119 | 0 | 85 | – |

| PEAK RESIDENCE | THOMSON ROAD | 90 | 0 | 0 | – |

| RESIDENTIAL APARTMENTS | CAIRNHILL RISE | 75 | 0 | 75 | – |

| RESIDENTIAL APARTMENTS | SHENTON WAY | 215 | 0 | 215 | – |

| SANCTUARY@NEWTON | SURREY ROAD | 38 | 0 | 36 | – |

| SOPHIA REGENCY | SOPHIA ROAD | 38 | 0 | 38 | – |

| THE ATELIER | MAKEWAY AVENUE | 120 | 0 | 0 | – |

| THE AVENIR | RIVER VALLEY CLOSE | 376 | 0 | 0 | – |

| THE GIVERNY RESIDENCES | ROBIN DRIVE | 6 | 0 | 6 | – |

| VAN HOLLAND | HOLLAND ROAD | 69 | 0 | 0 | – |

| WILSHIRE RESIDENCES | FARRER ROAD | 85 | 0 | 0 | – |

Unsold Condo Units in RCR

| Project Name | Street Name | Total No. of Units | Sales for Sep 23 | Total Unsold Units |

Average Price (PSF)* |

| GRAND DUNMAN | DUNMAN ROAD | 1008 | 16 | 428 | $2,571 |

| THE RESERVE RESIDENCES | JALAN ANAK BUKIT | 732 | 11 | 108 | $2,446 |

| THE CONTINUUM | THIAM SIEW AVENUE | 816 | 10 | 543 | $2,790 |

| THE LANDMARK | CHIN SWEE ROAD | 396 | 8 | 96 | $2,832 |

| PINETREE HILL | PINE GROVE | 520 | 7 | 373 | $2,395 |

| TEMBUSU GRAND | JALAN TEMBUSU | 638 | 4 | 266 | $2,399 |

| BARTLEY VUE | JALAN BUNGA RAMPAI | 115 | 3 | 24 | $1,908 |

| FORETT AT BUKIT TIMAH | TOH TUCK ROAD | 633 | 3 | 0 | $2,375 |

| TERRA HILL | YEW SIANG ROAD | 270 | 3 | 165 | $2,744 |

| LIV @ MB | ARTHUR ROAD | 298 | 2 | 7 | $2,306 |

| MORI | GUILLEMARD ROAD | 137 | 1 | 10 | $1,891 |

| MYRA | MEYAPPA CHETTIAR ROAD | 85 | 1 | 4 | $2,228 |

| THE REEF AT KING’S DOCK | HARBOURFRONT AVENUE | 429 | 1 | 14 | $2,667 |

| ZYANYA | LORONG 25A GEYLANG | 34 | 1 | 8 | $1,876 |

| AMBER PARK | AMBER GARDENS | 592 | 0 | 0 | – |

| AMBER SEA | AMBER GARDENS | 132 | 0 | 132 | – |

| ATLASSIA | JOO CHIAT PLACE | 31 | 0 | 9 | – |

| BLOSSOMS BY THE PARK | SLIM BARRACKS RISE | 275 | 0 | 61 | – |

| CANNINGHILL PIERS | CLARKE QUAY | 696 | 0 | 16 | – |

| CLAYDENCE | STILL ROAD/KOON SENG ROAD | 28 | 0 | 28 | – |

| GEMS VILLE | LORONG 13 GEYLANG | 24 | 0 | 24 | – |

| KENT RIDGE HILL RESIDENCES | SOUTH BUONA VISTA ROAD | 548 | 0 | 0 | – |

| LAVENDER RESIDENCE | LAVENDER STREET | 17 | 0 | 9 | – |

| MATTAR RESIDENCES | MATTAR ROAD | 26 | 0 | 26 | – |

| MEYER MANSION | MEYER ROAD | 200 | 0 | 2 | – |

| ONE PEARL BANK | PEARL BANK | 774 | 0 | 2 | – |

| PARQ BELLA | TEMBELING ROAD | 20 | 0 | 20 | – |

| PICCADILLY GRAND | NORTHUMBERLAND ROAD | 407 | 0 | 2 | – |

| RIVIERE | JIAK KIM STREET | 455 | 0 | 0 | – |

| ROYAL HALLMARK | HAIG LANE | 32 | 0 | 4 | – |

| SKY EVERTON | EVERTON ROAD | 262 | 0 | 1 | – |

| SUNSTONE HILL | BALMEG HILL | 28 | 0 | 28 | – |

| THE CARRARA | MOUNTBATTEN ROAD | 6 | 0 | 4 | – |

| THE HILL @ONE-NORTH | SLIM BARRACKS RISE | 142 | 0 | 142 | – |

| TMW MAXWELL | MAXWELL ROAD | 324 | 0 | 318 | – |

Unsold Condo Units in OCR

| Project Name | Street Name | Total No. of Units | Sales for Sep 23 | Total Unsold Units |

Average Price (PSF)* |

| ALTURA | BUKIT BATOK WEST AVENUE 8 | 360 | 100 | 44 | $1,473 |

| LENTOR HILLS RESIDENCES | LENTOR HILLS ROAD | 598 | 17 | 205 | $2,231 |

| NORTH GAIA | YISHUN CLOSE | 616 | 16 | 270 | $1,320 |

| POLLEN COLLECTION | POLLEN VIEW/POLLEN CRESCENT/POLLEN WALK/POLLEN PLACE | 132 | 8 | 96 | $2,185 |

| THE MYST | UPPER BUKIT TIMAH ROAD | 408 | 8 | 257 | $2,147 |

| THE ARDEN | PHOENIX ROAD | 105 | 7 | 68 | $1,799 |

| SKY EDEN@BEDOK | BEDOK CENTRAL | 158 | 5 | 22 | $2,113 |

| THE BOTANY AT DAIRY FARM | DAIRY FARM WALK | 386 | 5 | 168 | $2,047 |

| LENTOR MODERN | LENTOR CENTRAL | 605 | 4 | 46 | $2,026 |

| PASIR RIS 8 | PASIR RIS DRIVE 8 | 487 | 4 | 12 | $1,766 |

| THE LAKEGARDEN RESIDENCES | YUAN CHING ROAD | 306 | 4 | 235 | $2,068 |

| THE SHOREFRONT | JALAN LOYANG BESAR | 23 | 3 | 20 | $1,902 |

| KI RESIDENCES AT BROOKVALE | BROOKVALE DRIVE | 660 | 2 | 14 | $2,148 |

| SCENECA RESIDENCE | TANAH MERAH KECHIL LINK | 268 | 2 | 98 | $2,106 |

| PARC GREENWICH | FERNVALE LANE | 496 | 1 | 1 | $1,279 |

| PROVENCE RESIDENCE | CANBERRA CRESCENT | 413 | 1 | 0 | $1,490 |

| THE JARDINE RESIDENCES | LORONG CHUAN | 6 | 1 | 1 | $3,092 |

| AFFINITY AT SERANGOON | SERANGOON NORTH AVENUE 1 | 1052 | 0 | 0 | – |

| AMO RESIDENCE | ANG MO KIO RISE | 372 | 0 | 2 | – |

| BAYWIND RESIDENCES | LORONG N TELOK KURAU | 24 | 0 | 0 | – |

| BELGRAVIA ACE | BELGRAVIA DRIVE | 107 | 0 | 25 | – |

| CASHEW GREEN | CASHEW ROAD | 19 | 0 | 2 | – |

| COPEN GRAND | TENGAH GARDEN WALK | 639 | 0 | 0 | – |

| HILLOCK GREEN | LENTOR CENTRAL | 474 | 0 | 474 | – |

| J’DEN | JURONG EAST CENTRAL 1 | 368 | 0 | 368 | – |

| K SUITES | LORONG K TELOK KURAU | 19 | 0 | 15 | – |

| KOVAN JEWEL | KOVAN ROAD | 34 | 0 | 27 | – |

| PARC CANBERRA | CANBERRA WALK | 496 | 0 | 2 | – |

| PARC CLEMATIS | JALAN LEMPENG | 1468 | 0 | 23 | – |

| PARKWOOD RESIDENCES | YIO CHU KANG ROAD | 18 | 0 | 0 | – |

| PHOENIX RESIDENCES | PHOENIX AVENUE | 74 | 0 | 4 | – |

| PIERMONT GRAND | SUMANG WALK | 820 | 0 | 0 | – |

| RIVERFRONT RESIDENCES | HOUGANG AVENUE 7 | 1472 | 0 | 0 | – |

| RYMDEN 77 | LORONG H TELOK KURAU | 31 | 0 | 0 | – |

| SPRING WATERS VILLAS | JALAN MATA AYER | 6 | 0 | 2 | – |

| TENET | TAMPINES STREET 62 | 618 | 0 | 2 | – |

| THE COMMODORE | CANBERRA DRIVE | 219 | 0 | 0 | – |

| THE WATERGARDENS AT CANBERRA | CANBERRA DRIVE | 448 | 0 | 0 | – |

| URBAN TREASURES | JALAN EUNOS | 237 | 0 | 0 | – |

If you would like to receive the full monthly-updated list of unsold condo units in Singapore and other updates via email, simply just indicate your interest by using the form below.

Final Word

Let’s face it – when the Singapore property market was experiencing a downturn from 2014 to 2016, many homebuyers or investors were thinking that the market was going to crash and thus hoping to rip a good deal (or a cheap one) from sellers or developers.

Unfortunately, that did not happen as frequently as most would hope for.

Similar sentiments were felt over the last 2 years when the nation was affected by the COVID-19 pandemic.

However, prices remain strong in the new home segment, and the buying demand keeps increasing.

In fact, by looking at the current price points of these developments with unsold condo units in Singapore, you will never be able to find anything that matches the price points which were seen in 2014 – 2016.

In my opinion, there’s absolutely no rush to buy into the new launch property market right now.

This is because we are expecting more projects to be released in 2023 & 2024, and I believe they will be listed for sale at very competitive price points due to supply in the market.

Hence, you can take your time within these 2 years to pick the right one that suits your needs as it is the most ideal window to purchase a new launch condo.

I am not saying that all of these unsold condos listed are good buys, but it certainly helps if you study this list over time as I continue to update it.

Pick the one that matches your own requirements and the one that fits you.

If you need help or a real-time update on the condominium of your choice, you can always reach me via WhatsApp or drop me a note using the contact form below.

Thanks for reading and please help to share if you find this article useful.