What can you do with rising mortgage interest rates in Singapore?

A big surge in mortgages rates see fixed rates risen up to 3.08 percent.

With more residential projects, such as AMO Residence and Lentor Modern that will be launched for sale in 2022, rising mortgages will no doubt cause some form of uncertainty.

Here’s an abstract taken from Channel NewsAsia, which should give prospective home buyers and owners a clearer picture of the entire situation.

If you are a homeowner, you may have received a letter from your bank recently informing you that your mortgage rate is going up.

Mortgage rates in Singapore are rising as global central banks increase interest rates to fight inflation.

So the question is – how much higher will mortgage rates be?

And for homeowners, what can you do?

Why are mortgage interest rates rising?

Global central banks have been tightening the monetary policy in order to fight rising inflation.

In particular, interest rates have been hiked by the US Federal Reserve 3 times this year, with more rate hikes on the table.

A more hawkish Fed will mean that Singapore’s interest rates will go up over time.

This is because Singapore’s interest rates are highly influenced by global market movements, especially that in the United States, which is the world’s largest economy.

So far, local interest rates have gone up.

For example, the Singapore Overnight Rate Average (SORA).

A 3-month compounded SORA has gone up to 0.74 percent in June as compared to 0.19 percent at the start of the year.

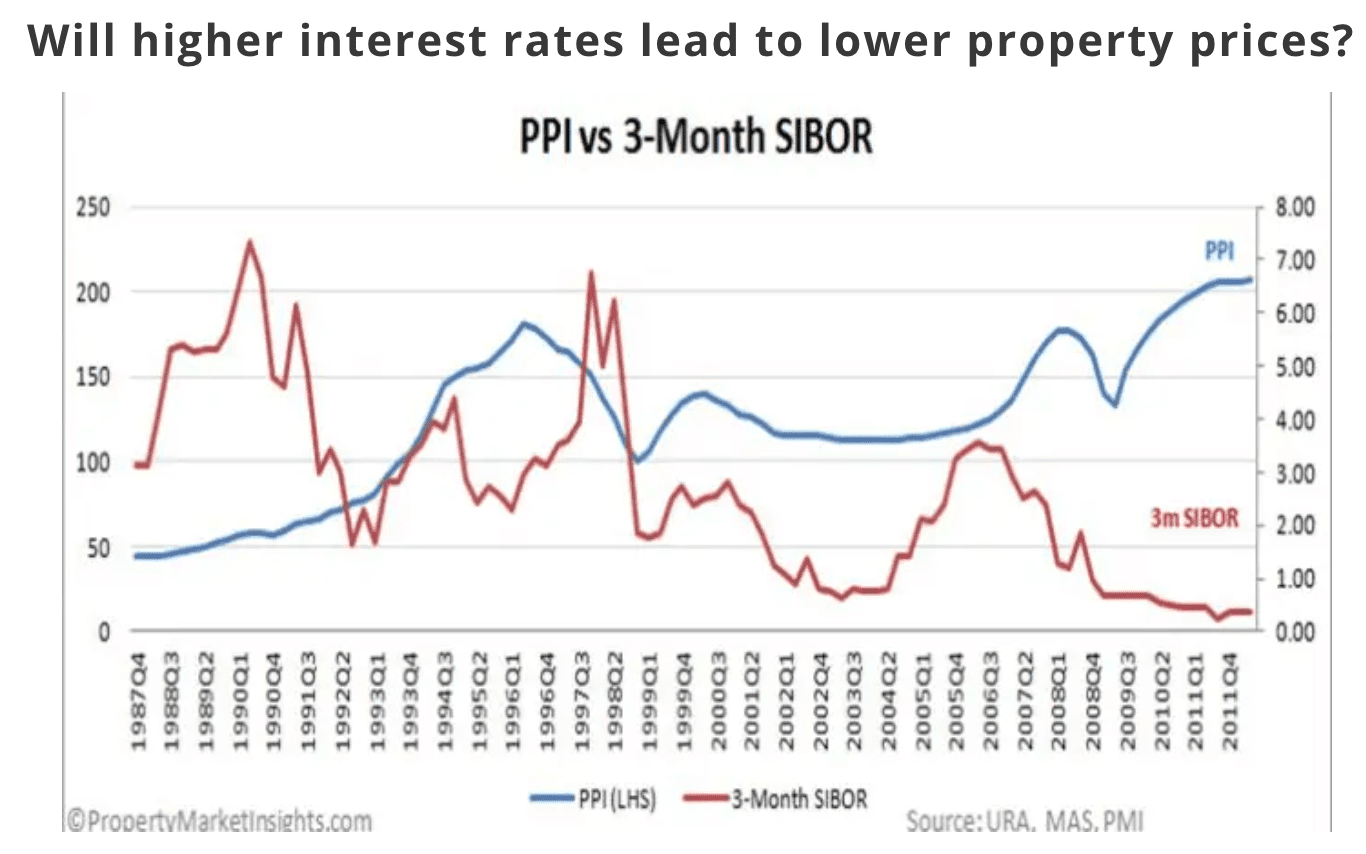

Then there is SIBOR or the Singapore InterBank Offered Rate.

Now this rate is highly correlated with US interest rates and has gone up even more.

The 3-month SIBOR has gone up to 1.56 percent in June as compared to 0.44 percent in January.

How much have mortgage interest rates changed?

Many floating rate home loans here are pegged to the SIBOR and the SORA, so homeowners owners on these loan packages would have already felt the impact.

Fixed rate mortgages have also seen big adjustments.

In general, 2-year and 3-year fixed rate mortgages have seen their rates go up from just above 1 percent at the start of the year to nearly 3 percent in June.

The 3 local banks, DBS, OCBC, and UOB said they constantly adjust their price packages in line with market conditions.

How much higher can interest rates go?

Analysts have said that mortgage rates will go up even more as the Fed plans to keep raising interest rates to fight inflation.

At least 2 analysts have mentioned that they expect fixed rate and floating rate home loans to cross 3% by the end of the year.

More fixed rate plans, especially those over a longer duration, could even be scraped if interest rates become too volatile.

There is also a forecast from many economists who expect mortgage rates to hit 4 percent by the end of the year.

If true, this will be a level unseen in almost 2 decades.

So what should homeowners do?

Experts are advising homeowners to start reviewing their mortgages.

There are 2 ways to do so. It’s either by refinancing or repricing.

If you refinance, it means you are switching to a different bank.

If you reprice, it means you are switching to a different loan package within the same bank.

The several factors to consider.

For example, the age of a loan, administrative costs, and the actual savings that you enjoy.

As interest rates continue to increase, some experts are also advising homeowners to switch to a fixed rate home loan instead of one with a floating rate.

But if you are unsure, at least 2 local banks in Singapore are offering hybrid loans that will allow you to pay half of your loan at a fixed rate and the remainder at a floating rate.

Such an option, according to the banks, will help borrowers to hedge against any upcoming hikes.

Lastly, if you’re on a SIBOR-linked home loan, you may want to consider switching to one that’s pegged to SORA.

This is because SORA has tend to react slower to interest rate hikes.

Also, the SIBOR will be phased out from 2024. Hence, it might be better to do the switch sooner rather than later.