Decoupling Private Property – How does it work?

Widely adopted by homeowners to buy a subsequent residential property in Singapore without being liable for Additional Buyer's Stamp Duty (ABSD)

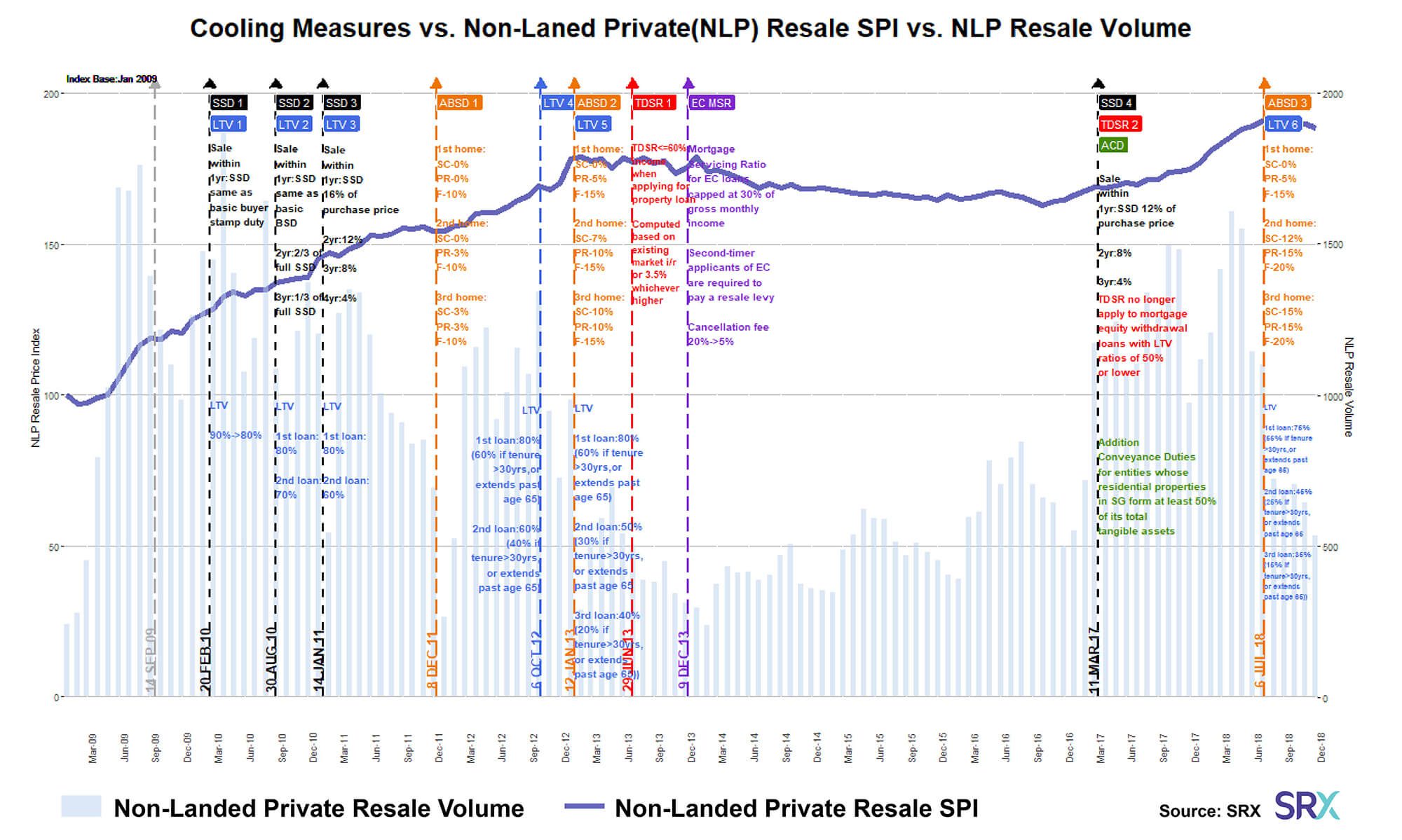

The Additional Buyer’s Stamp Duty (ABSD) was first introduced in Singapore back in December 2011.

For almost the last 10 years, there were several rounds of revision upwards to the ABSD rates.

As a result, decoupling private property has been one of the most popular methods used by homeowners to avoid paying ABSD for their subsequent property purchases.

These private homeowners are usually couples (husband & wife) who are financially strong.

Hence, it’s not applicable for those who have liabilities and personal debts.

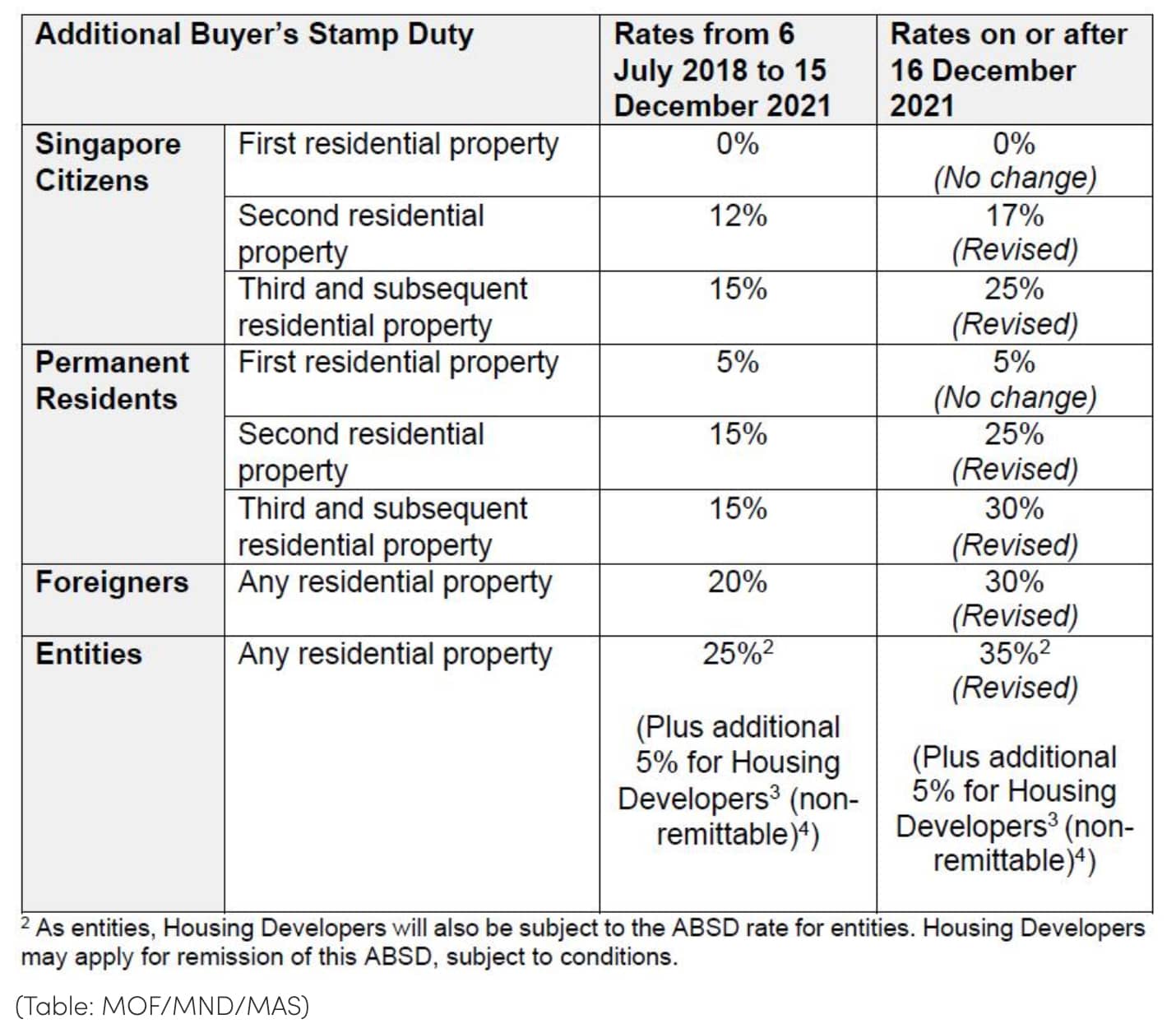

Let’s take a look at the current ABSD rate (revised on 16 December 2021).

For instance, if you are a Singapore citizen who’s buying a 2nd property at $1 million, previously you would have to fork out an ABSD of $120,000.

Based on the latest rates, you will now have to fork out $170,000.

And if decoupling is applicable to the private property that you currently own, you would have saved that $170,000.

I’ve spoken to many private homeowners over the years and the most common reason they are not doing it is that they thought it was too complex, or thought it was an illegal process.

Is Decoupling Private Property Illegal and Is It Complex?

The first thing to address in this post – decoupling private property is 100 percent legal in Singapore.

It’s not some dodgy process or a loophole in the legal system.

Secondly, it’s not a complex process.

As a matter of fact, decoupling is more straightforward than you actually think and your subsequent property purchase can either be a new launch or resale.

Unlike most articles or posts you’ve read, I’m going to simplify the process by giving you a case study/example.

I believe it would be easier for you to see the entire picture and see if it relates to you.

How Decoupling Works in Singapore

Here’s a classic scenario of decoupling private property.

The situation

John and Mary are owners of a private condominium unit.

They are both Singapore citizens.

They would like to decouple and take John’s name out of the property so that John can buy another residential property at Normanton Park without the need to pay ABSD.

In other words, Mary will be buying over John’s share of the property.

The process

Step 1

Firstly, John will have to arrange for a law firm to do up a Sale & Purchase agreement to sell his shares to Mary.

Meanwhile, Mary will also have to engage a law firm to assist with the purchase of John’s shares of the property.

They both have to engage different law firms to avoid conflict of interest.

Concurrently, Mary will have to apply for a housing loan (if required) to buy over John’s share of the current property and to refinance over the existing mortgage loan (if any).

Step 2 (Concurrent with Step 1 above)

Mary will proceed to buy John’s share of the property. It will be generally the same procedure as buying a private property in Singapore.

Mary to pay:

- Exercise money 5% (cash)

- Buyer’s Stamp Duty

- Additional Buyer Stamp Duty (if required)

Step 3

The law firm that is representing Mary will apply for CPF / apply to the bank to disburse the monies for Mary to pay John on the completion of the decoupling transaction.

Completion Date (Arrange for at least 3 months from the date of Step 1)

Mary will complete the purchase with John.

Payment by Mary to John can be by cash and/or loan and/or CPF

NOTE:

John can only exercise the Option to Purchase (OTP) for Normanton Park after Step 1 & 2 are completed

Most importantly, if John would like to reuse the CPF refunds from the CPF used in the existing property, the timing for the completion of Normanton Park to take place at least 3 weeks after the completion of the decoupling.

To sum up, decoupling private property isn’t rocket science.

However, it’s important you know the fundamentals and has proper planning.

Do note that all the above information and scenario serve as a general guide. The decoupling situation may vary according to each individual’s case.

If you’re interested to find out more and a better understanding of the process, timeline, and finances involved, you can always reach me using the form below or you can just drop me a WhatsApp message.