While analysts have recently forecasted a new peak in property prices by end 2018, another property cooling or rather a tweak has been introduced by the Singapore government.

On 05 July 2018, the government has announced that adjustments will be made to the existing Additional Buyer Stamp Duty (or ABSD) rates and also tightening up the Loan-to-Value (or LTV) limits in order to cool off the residential property market and keep property prices in line with the nation’s economic growth.

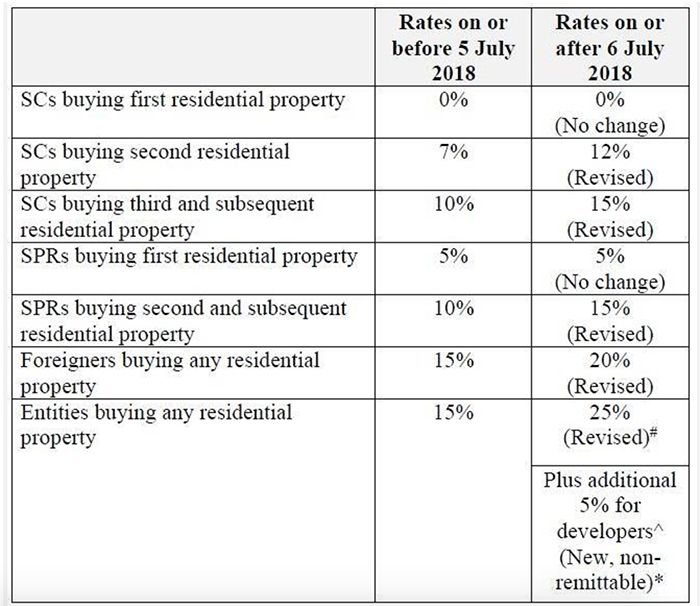

In a joint press release by both the national development and finance ministries together with the Monetary Authority of Singapore (MAS), the authorities mentioned that the existing ABSD rates will be raised by 5% for Singapore citizens or permanent residents (PRs) purchasing 2nd and subsequent residential properties in Singapore, and 10% for entities.

There will be an introduction of an additional 5% of ABSD for property developers who will be acquiring residential properties for redevelopment purposes and this will be non-remittable stated under the Remission Rules.

Limits on LTV will also be tightened by another 5% for all housing/mortgage loans granted by banks or financial institutions.

The authorities have noted that there has been a sharp increase of 9.1% in private property prices over the past 1 year and if the surge is being left unchecked, it could possibly run ahead or outgrow the nation’s economic fundamentals – which could increase the risk of destabilising future correction, especially with the ongoing increase of mortgage interest rates and the number of housing supply in the pipeline.

On that note, the government has also recently maintained its land supply under the 2H 2018 Government Land Sales programme.