While it took 4 years of correction in Singapore’s property market to finally bring prices down by 11.6% in the 2nd quarter of 2017, it may take only 15 to 18 months of market recovery to bring property prices back to its former high if the current buoyant market sentiment and momentum continues.

Market watchers believe that the private residential market may see a new peak in prices by the end of 2018 as property developers continue to roll out new launch projects on sites which they have acquired previously at significantly exorbitant prices.

According to the Urban Redevelopment Authority (URA), flash estimates have shown that private residential property prices have risen for the 4th straight quarter – up by 3.4% in 2Q2018 after a 3.9% surge in 1Q2018.

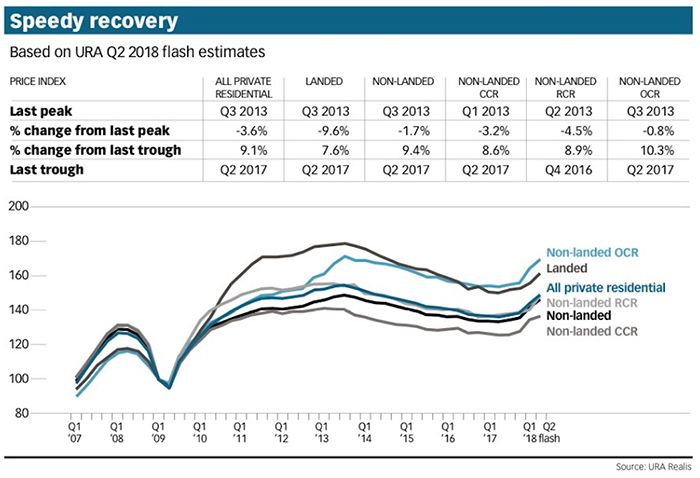

As a result, the overall private home price index from URA is 3.6% off its last peak (back in 3Q2013) and 9.1% higher than the last gutter in 2Q2017. Looking at each individual region, the suburban region or OCR (Outside Central Region) is just 0.8.% short from its last peak.

Analysts said that the market sentiment is currently steering towards another peak and property prices will probably recover to its former peak (in 2013) within 1 to 2 quarters this year unless the government chooses to intervene – likely with another cooling measure or policies which will threaten the market’s ongoing recovery.

They’ve added that in coming quarters, there may be more upside for non-landed private home prices in the Core Central Region (CCR) given that there is a strong line-up of residential projects which could be launched – such 3 Orchard By-The-Park by YTL Corporation, 8 St Thomas by Bukit Sembawang and South Beach Residences by City Developments.

It was also noted earlier that 2 projects over last weekend – Park Colonial and Stirling Residences, have both drawn a total of around 16,500 prospects to the opening preview at their respective show flats.