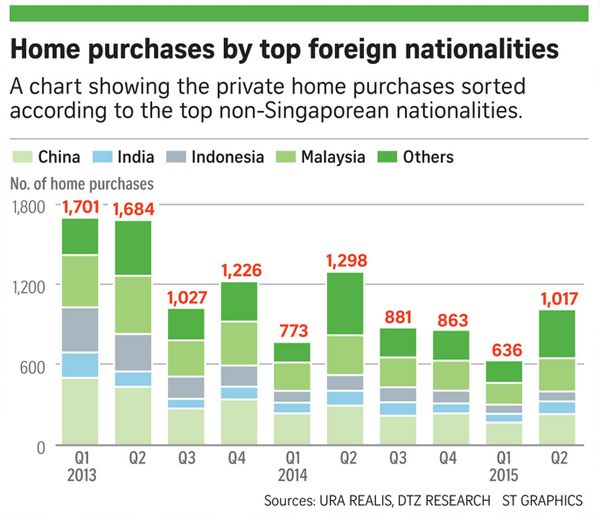

Since the last global financial crisis, the number of foreign property buyers, which include the Chinese has fallen to its lowest point, leaving the Singapore property market to rely on local property buyers whilst facing the rise of interest rates domestically.

According the latest compilation of real estate transaction data in Singapore, foreign property buyers, including the Singapore PRs (permanent residents), purchased a total of 499 homes in 4Q2015.

This has accounted for approximately 16% of the total transactions in a single calendar year. It is significantly lower than 3Q2011 when more than 30% of the transactions were contributed by foreigners, which was just before the Additional Buyer’s Stamp Duty (ABSD) was imposed as a cooling measure to the heated property market then.

While widely considered as a safe haven for property investments, foreigners have been dismayed and holding back their purchase of properties in Singapore. This Chinese buyers who make up the largest bulk of foreign property purchases of Singapore private homes, have bought only 151 units between October to December 2015, which was almost a 40% plunge from figures recorded in 2014 and 80% down from the peak in 3Q2011.

The Singapore property market outlook 2015-2016

The recent trend shows that most Chinese buyers have diverted their attention to property markets in UK and Australia.

In order to capitalize on funds from these Chinese investors without drawing a huge influx of ‘hot money’, property experts have suggested that the stamp duties need to be readjusted to a level where properties in Singapore still looks attractive to these buyers.

On the other hand, local property buyers may be turning cautious too as the 3-month Singapore Interbank Offered Rate (also known as SIBOR) is on a continual uptrend and is now the highest since October in 2008.

It was noted by property consultancy firm, JLL that the private residential property prices in Singapore are expected to decline further in 2016 as market sentiments resemble the levels seen during the recession in 2003.

Since a slew of property cooling measures introduced from 2010, the demand for property purchases and prices have weakened significantly – especially in the high-end and mass market residential segment where prices have fell about 20% since 2011.

However it was added by JLL that the prime residential property segment still remains fairly attractive to investors as home prices in the high-end market are still approximately 165% lower than the luxury properties Hong Kong and 92% cheaper than those in London.

Due to the weak economic growth and demand from the finance industry sector, which makes up a big portion of the prime office spaces located in the Central Business District of Singapore, the take-up rate of such commercial spaces have also declined.