New private home sales in Singapore rose by 9 percent month-on-month, 39 percent year-on-year in 2021

Demand likely to continue outstripping supply towards end of the year

New private home sales in Singapore have rebounded by 9 percent from September to October 2021. That’s followed by 2 consecutive months of decline.

The number of units soared from 834 units to 909 units according to statistics from the Urban Redevelopment Authority of Singapore.

Despite the strict safe distancing measures imposed by the government to slow down the spread of COVID-19 and no major new launch projects announced, the demand for housing has continued to stay resilient over the last month.

Compared to 1 year ago, new home sales (inclusive of executive condominiums) have risen by 50.6 percent.

In the first 10 months of 2021, approximately 10,918 new homes have been sold.

This has surpassed the 9,982 units that were sold for the entire 2020.

In October 2021 alone, the demand has held up well across all residential property market segments as the OCR (excluding ECs) registered 38.2 percent of the sales, and both CCR and RCR have registered 30.9 percent respectively.

Analysts added that some property developers for residential projects within the CCR have renewed their marketing efforts as Singapore slowly eases numerous travel restrictions for more foreign buyers to enter Singapore.

In addition, more property buyers could shift their attention to the existing inventory of unsold condo units in the CCR as the number of residential projects in suburban regions decreases.

This could spell the perfect time for CCR projects such as Canninghill Piers to be launched.

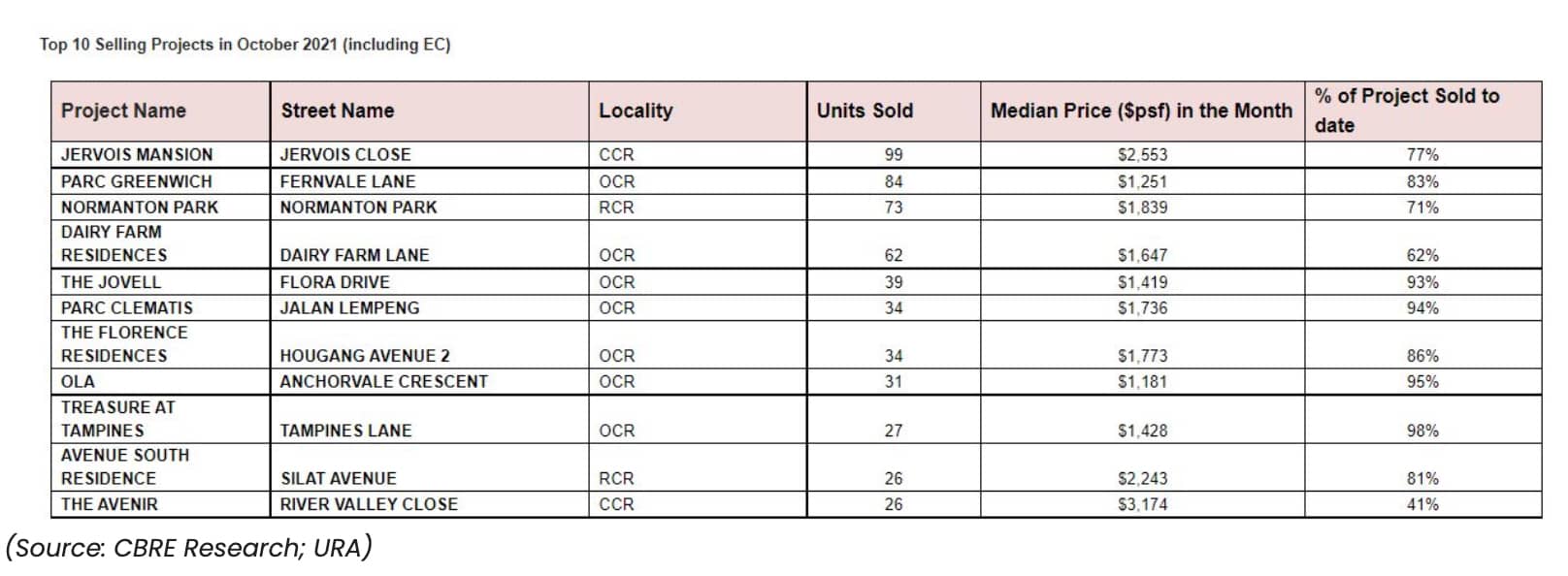

In October, the best-selling private residential project was Jervois Mansion at an average psf price of $2,553. Normanton Park came in second at a median psf price of $1,839.

One of the most notable transactions in October was a penthouse unit at Les Maisons Nassim by Shun Tak Holdings.

This ultra-luxury unit was sold for a whopping $75 million ($6,210 psf), making it the most expensive condominium purchased since 2011 – based on psf.

Demand has begun to outstrip the supply for private properties across all property market segments, and consultants believe that the market will continue to be buoyant in both November and December.

Market watchers expect private home prices to continue rising by around 6 to 7 percent and expect total new homes to be sold up to 12,000 by the end of the year.