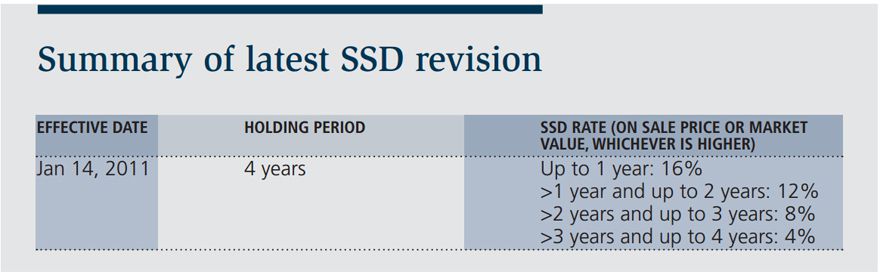

Based on transacted data and matched caveats information from the Urban Redevelopment Authority (URA), a total of 1,700 non-landed residential units transacted were affected by the Seller’s Stamp Duty (SSD) which was last revised on 14 January, 2011. These units were sold within 4 years from the date of purchase and therefore incurred SSD, ranging from 4% to a maximum of 16% of the sale price. In some cases, the market value was used instead as it was higher than the sale price. Since the SSD was in place, a total estimate of S$80 million were collected, based on the transacted sale price.

The top 20 transactions affected were required to pay a total of more than S$9 million. The highest amount of SSD paid by a non-landed residential unit alone came from Four Seasons Park, which incurred a whopping S$1.14 million of SSD. Among these transactions, if not for the SSD, 7 of the sellers would have made a decent profit from the sale of their property. For instance, a residential unit at The Trillium changed hands in January 2013 with a profit of S$549,800. However, the seller incurred a 12% SSD (S$719,880) as the unit was sold in within 2 years from the date of purchase, thus resulting in a negative sale and loss of S$170,080 instead.

Apparently, despite the hefty SSD in place, 1,479 (87% of the 1,700 units transacted) non-landed residential units still managed to make profits after deducting the SSD incurred. For these units, a total of S$52 million were collected for SSD, which still resulted in a decent net profit sum of S$255 million.

Out of the 1,700 transactions, 105 of them could have made a profit if not for the SSD, which in the end resulted in a net loss. It was also noted that 30 of these 105 transactions were sold within the 1st year of purchase (thus incurring 16% SSD on sale price).

There were a total of 109 transactions out of the 1,700 caveated were sold at prices which were even lower than the price they bought at, resulting in a total loss of S$19 million for these sellers. The deficit was worsen by the SSD incurred by these sellers (estimated S$13 million), thus adding up to a total net loss of S$32 million. This works out to an average estimate of almost S$300,000 loss suffered for each transaction.

Being one of the key cooling measures in place, the main purpose is to discourage speculators from “flipping” their properties or trying to reap quick profits from selling their properties after holding on for a short period of time. Of course, this is only lucrative if the property market pricing is trending upwards. However, recent data on property prices from URA have indicated that the property price index has fallen by 5% to 140.9 in 2Q2015 from 3Q2013, which we saw a peak of 148.9 then. In today’s challenging market situation, the SSD indeed adds burden to the sellers who might be forced to dispose their property due to reasons such as losing income from unemployment and weakening cash flow. Experts have suggested that a capital gain tax should be adopted instead of SSD. This is something that has been applied in property markets such as United Kingdom and Malaysia etc as it will serve its purpose of deterring property buyers from speculating the property market, and yet it does not add up to the sellers’ losses which they have already incurred.