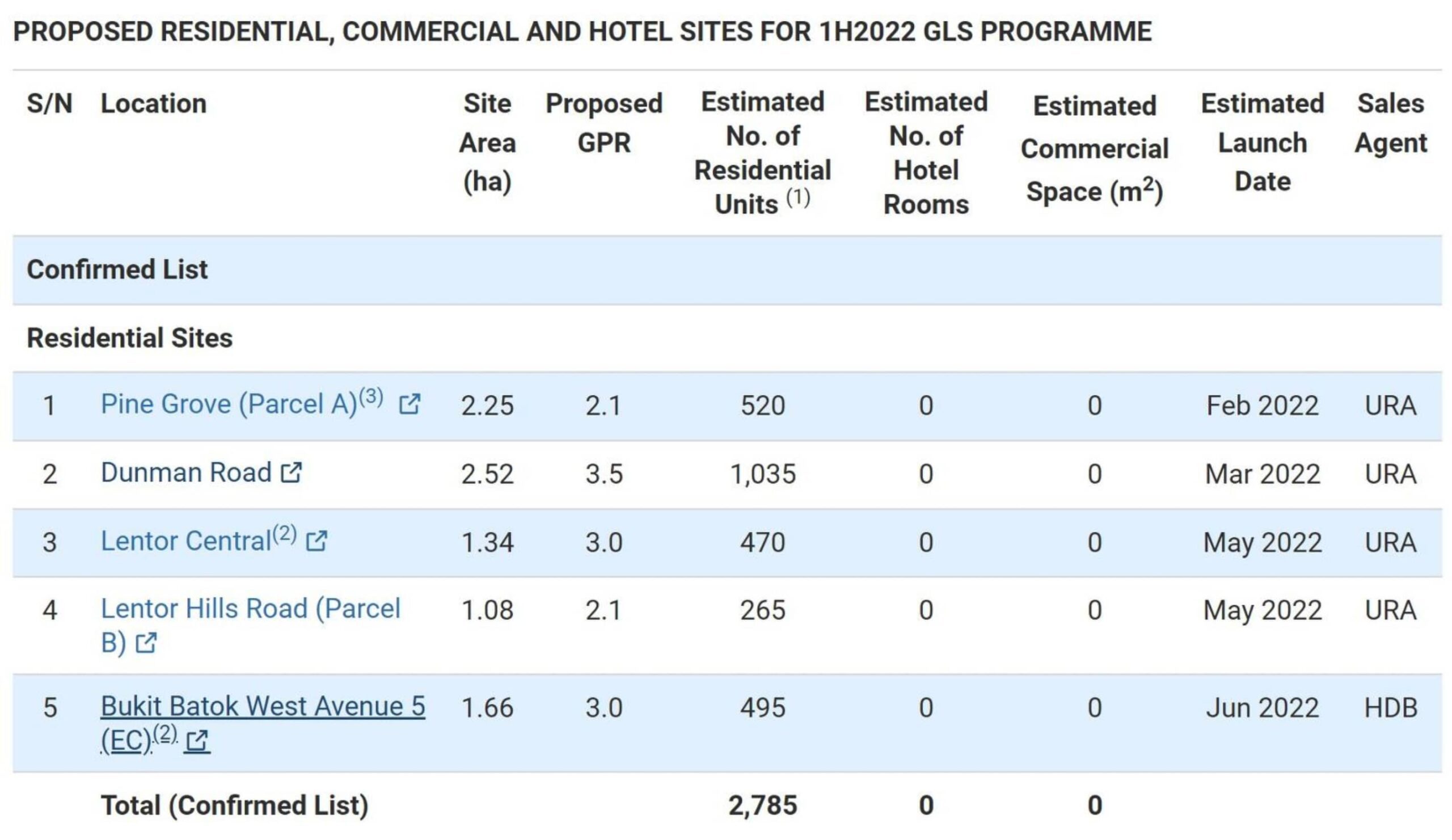

13 sites for sale under 1H 2022 Government Land Sales (GLS) Programme

It comprises of 5 sites on the Confirmed List and 8 sites under the Reserve List in total.

Followed by the announcement of the new property cooling measures, the Singapore government has announced 13 sites for sale under the 1H 2022 Government Land Sales (GLS) Programme.

The list comprises 5 and 8 sites on both the Confirmed and Reserve Lists respectively.

Under the Confirmed List, there will be 4 sites from private residential developments, and 1 site for executive condominium (EC).

In total, these 5 sites can potentially yield around 2,290 private homes and 495 EC homes.

The private residential site that could yield the most number of units is the Dunman Road GLS site, which could yield 1,035 private homes.

According to Cushman & Wakefield, the site has a good location as it’s within close proximity to the Dakota MRT station.

In addition, it’s also close to amenities such as the Old Airport Road food center.

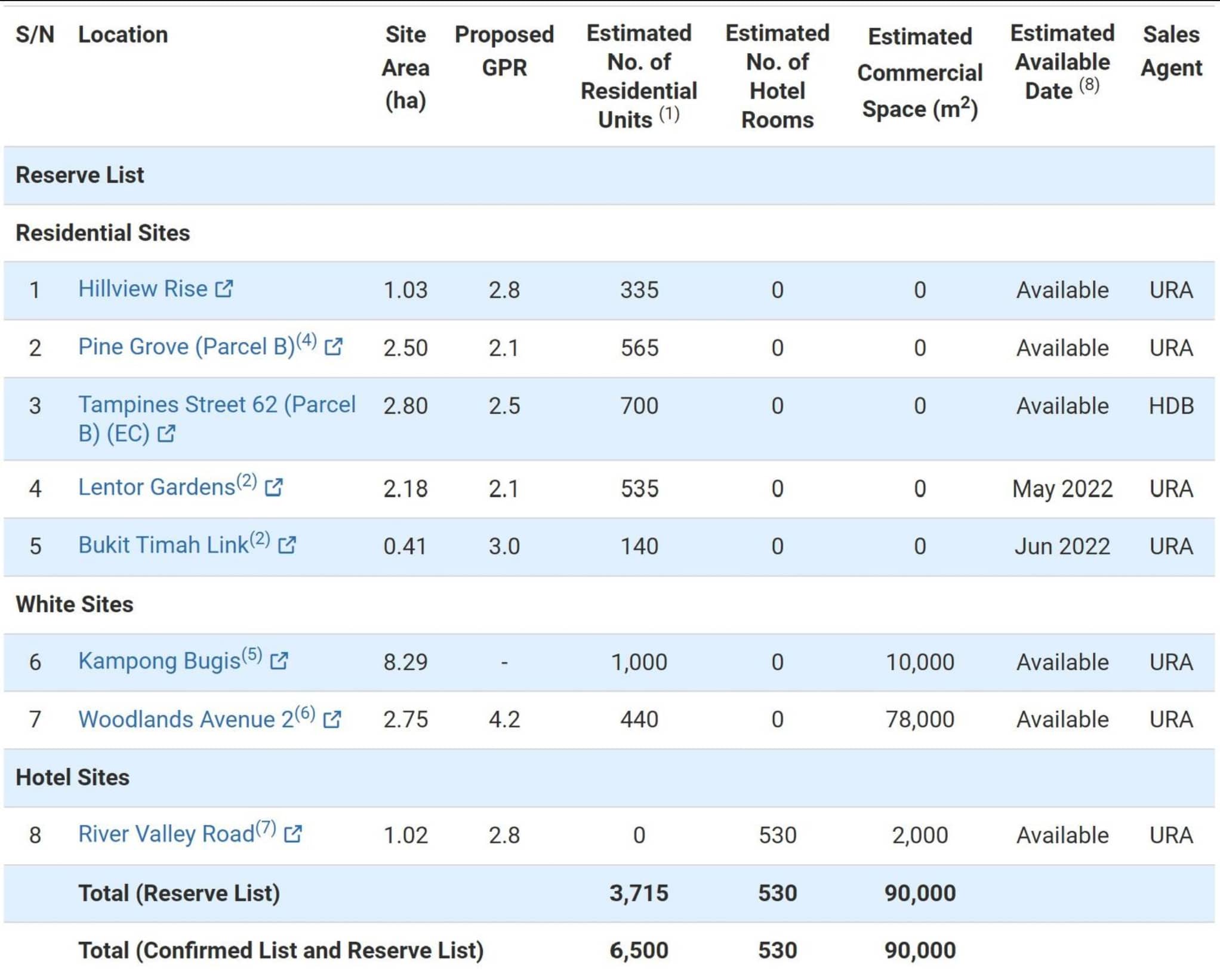

On the other hand, the Reserve List comprises 4 sites for private residential, 1 for EC, 2 White sites, and 1 for hotel development.

These sites could add another 3,715 units in total – with 2,275 units being potentially yielded from the private residential and EC sites.

Analysts believe that with the dwindling unsold condo units in Singapore (from new launches), developers will naturally need to replenish their land banks.

Hence, this increase in land supply is welcoming news by the Ministry of National Development (MND).

However, the new cooling measures may dampen demand that will likely exert some downward pressure on the potential land bids. This will eventually have an effect on the future selling price.

It was also noted that more lands are being released for sale in the Rest of the Central Region (RCR) and Outside Central Region (OCR).

Market watchers mentioned that the 1H 2022 GLS Programme could well be a timely injection of supply as private home demand in these 2 sub-markets has been very resilient and strong.

It’s mostly due to the reason that these regions are supported mainly by Singaporean buyers who are looking to upgrade or make entry into the private residential market

According to data provided from PropNex, the number of new homes that are unsold in the Core Central Region (CCR) was 6,880 units, 5,878 units in the RCR, while 4,382 units in the OCR, as of the end of 3Q2021.