Property developer Sim Lian has successfully acquired the 560-unit Tampines Court for a whopping S$970 million – the largest collective sale for an ex-HUDC since Farrer Court for S$1.34 billion back in 2007.

This was, in fact, Tampines Court’s third attempt at an en bloc after 2 previous attempts which failed.

According to the collective sale price, it works out to be approximate S$676 per square foot per plot ratio (psf ppr), and each owner at Tampines Court will stand to gain a payout between S$1.71 million to S$1.75 million.

In addition to the sale price, Sim Lian will be required to make 2 separate payments (working out to an estimate of S$359 million) to the state – for the enhancement of intensity of the site to a 2.8 gross plot ratio and to top up the existing lease tenure of the site to a fresh 99-year (which currently has 69 years left).

Market watchers are expecting the future new launch on this 702,164 square feet (sq ft) site to yield more than 2,000 private homes. Some said even as many as 2,600 units if the site is being stretched to its limits.

The eventual break-even price for these new homes at Tampines Street 11 will work out to be around S$1,050 to S$1,150 psf.

It was mentioned in the earlier report when Tampines Court was being put up for en bloc sale that this deal could either bring a windfall to the developer, or disaster.

Property consultants have highlighted the scale of the project could be the main reason why there was only 1 developer involved this tender.

Sim Lian will only have a 5-year window to develop and completely sell out all of its units at this future new launch at Tampines Street 11, in order to avoid paying additional buyer’s stamp duty on the price of the site.

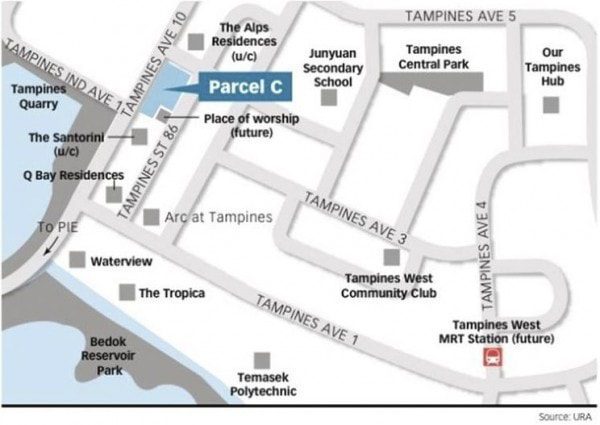

To add on the further pressure to the sale, CDL’s acquisition of the site at Tampines Avenue 10 could mount some serious competition for potential buyers who are looking for new condo projects in the Tampines precinct.

As government continues to limit the land supply in the latest 2H2017 Government Land Sales (GLS) programme, it is expected that home owners for older developments could be jumping on the collective sale bandwagon in the next 3 to 6 months and this will be an appealing alternative for developers who are looking to replenish their depleting land banks.

To date, 2 more estates – Florence Regency (a former HUDC) and Normanton Park condo have all been launched for collective sale, with price tags of at least S$600 million and S$800 million respectively.