Declining prices. Falling transaction volumes. Buyers on the sideline. Sellers with huge stocks to clear – the Singapore private property market is looking very gloomy. Private residential transactions are expected to fall by 20% year-on-year, alongside with the decline of property prices around 4 to 6% by the end of 2015.

Since the cooling measures such as the Total Debt Servicing Ratio (TDSR) was introduced, private property prices have been on a downward spiral. The overall private property index has fallen by 7.2% since its peak in 3Q2013. Alongside this, transaction volumes have also been contracting. The first 2 quarters of 2015 saw sales transactions cut down to over just 2000 units, with the modest price correction of 2% from the end of 2014.

But PropertyGuru says that the bottom of the property cycle is in sight, and could come by the end of 2015. As mentioned by CEO of PropertyGuru, Steve Melhuish, the percentage decline so far this year is approximately 3.5%, slightly lesser than as compared to 4.3% in 2014. The challenge around the private property market is that the transaction volume is still very low, but a good thing is that it’s stabilizing, according to Mr Melhuish. He believes that as we move towards the end of 2015, the rate of price decline and volume will start to moderate, reaching the end of the “bad story” in terms of the property market, but still not quite there yet.

However, Christine Li, research director of property consultant firm Cushman & Wakefield thinks otherwise. She doesn’t feel that the Singapore property prices will be bottoming out by the end of 2015 as the demand for private homes is still rather weak. Also with the surge in the unemployment rate as companies downsize, it’s unlikely for property buyers to jump into the market especially when prices are still moderating and not going up.

Other experts have also mentioned that they do not expect property prices to bottom out soon because there will be a steady supply of homes within the next 2 years, such as new homes which are due for completion and these new owners may also have their old houses to be put onto the market. For that, the supply can be substantial to keep property prices in check.

This year in 2015, according to the Ministry of National Development (MND) about 26,000 private new homes will be coming on stream and approximately another 28,000 units will be completed by the end of 2016, which are mainly from the suburban or outside-central regions. Due to this “oversupply”, OCR (Outside Central Region) property prices are expected to decline faster than those of the other regions. But prices in the central of Singapore, or Core Central Region (CCR) are expected to hit bottom first.

As mentioned by Mr Melhuish, from what we are seeing in CCR, Singapore property price decline was very heavy in 2014 and has halved in 2015. Thus the rate of decline in CCR is not producing as much as it was before. It was also noted that on the flipside, OCR prices didn’t really decline much last year, but it actually declines a lot faster this year.

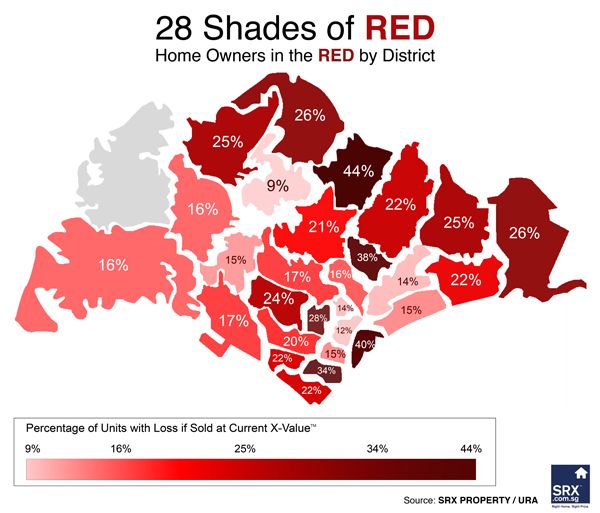

And while the government’s decentralization of business centers away from the Central Business District of Singapore, has increased the popularity of suburban condos, Cushman & Wakefield believes now is not a good time to invest in OCR. So far ever since the peak in 2013, prices have only declined by approximately 3% in the OCR, as compared to 8% in the CCR. If we were to look at inventory list in the OCR, there are many condominiums projects in the pipeline and coming onto the market. Due to weak leasing demand in the region, we may not see a lot of residential properties get rented out.

Though market sentiments are weak, still there were some successful new launch developments in the mass market segment during 1H2015, namely Kingsford Waterbay, North Park Residences and Botanique at Bartley. Overall, property developers are taking the cue, with the total number of new launches reduced to half from the numbers in 1H2014. They are also pricing existing inventory 10 to 15% lower. With Singapore property price index falling, buyers are even more price-sensitive.

The main concern from buyers is that with the price which they are picking up their property for in today’s market, how much more can it appreciate in future and not so much on the location of the property. And furthermore, property buyers are not showing any kind of urgency to buy and don’t mind playing the waiting game in order to achieve the price which they desire.

According to the PropertyGuru’s analytics on property searches, before it becomes a transaction, it seems like property buyers are now taking approximately 9 months on average to make their property purchases, as compared t0 only 6 months in the past. It was also highlighted that even though these property buyers are seriously looking to purchase, they are still having doubts about the property market prices and believe it may still go down a little bit more.

However, on a positive note, experts believe that as prices moderate moving in 2016, sales volume will also pick up. It’s because developers/sellers become more realistic on the prices and all they need to do is to go down a little more on the asking price, that will be a good entry for the purchasers.