Budget 2023: Property buyers’ stamp duty to increase from 15 Feb 2023

The adjustments are projected to affect 15% of all residential properties.

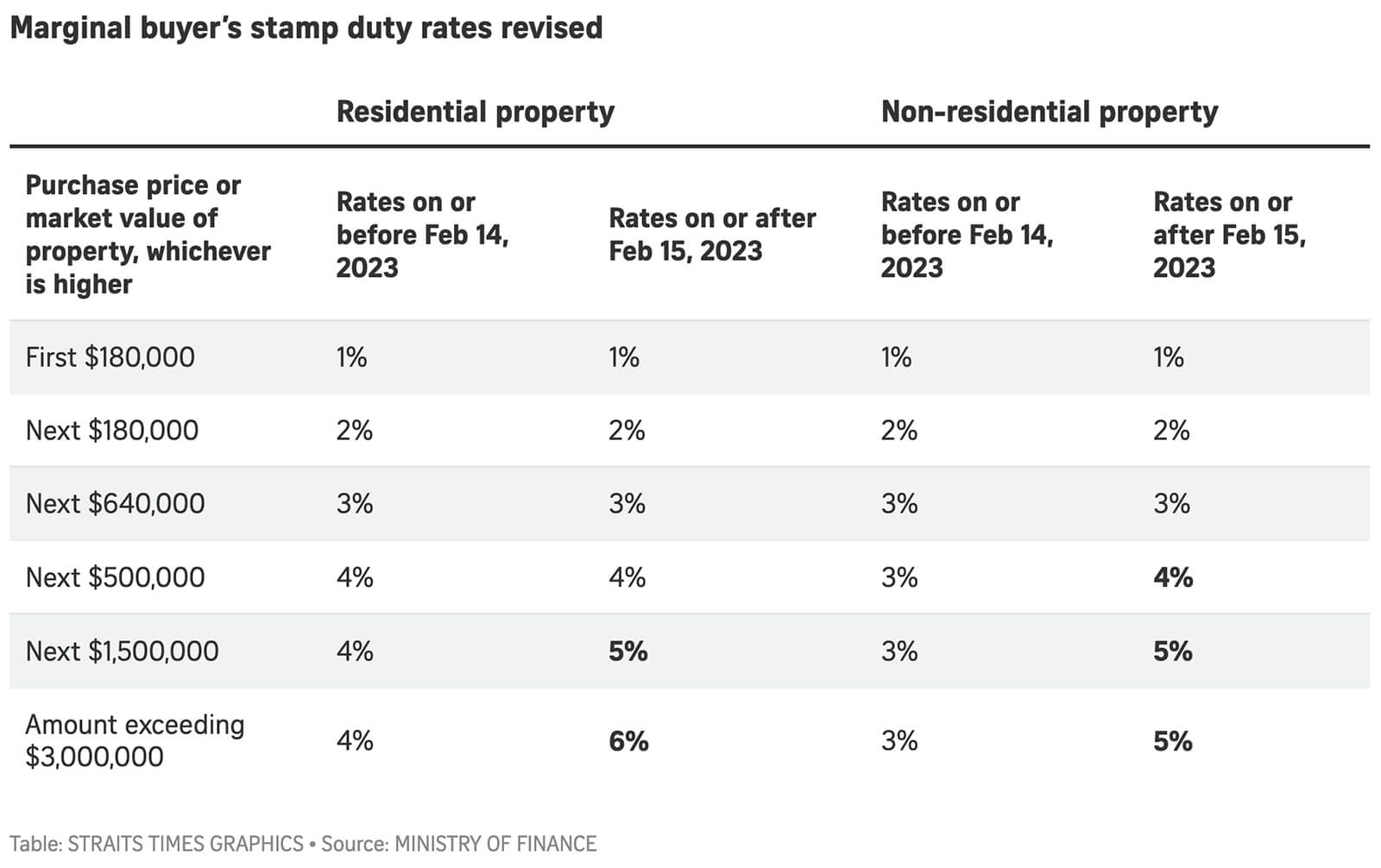

Finance Minister of Singapore, Lawrence Wong announced in his Budget speech on Tuesday that, from Wednesday, buyer’s stamp duties (BSD) on both residential and non-residential properties of greater value will be increased.

It is anticipated that this will generate an extra $500 million in annual revenue.

However, the precise amount will be dependent on the condition of the real estate market, he said.

For residential properties in Singapore, the portion of the property’s worth exceeding $1.5 million and up to $3 million will be taxable at 5 percent, while the amount over $3 million will be taxed at 6 percent.

This is an increase from the existing rate of 4 percent.

This is an increase from the existing rate of 4 percent.

The stamp duty adjustments are anticipated to affect 15 percent of all residential properties.

For non-residential properties, the portion of the property’s value exceeding $1 million and up to $1.5 million will be taxed at 4 percent, while the amount over $1.5 million will be taxed at 5 percent. This is an increase from the existing rate of 3 percent.

Mr Wong stated that these revisions are anticipated to affect 60 percent of commercial and industrial establishments.

Additional transfer duties applicable to eligible purchases of equity interests in property holding entities will increase from up to 44 percent to up to 46 percent.

Singapore taxes wealth in a variety of ways, namely property tax, stamp duties, and additional vehicle registration fees.

In 2018, the BSD rate was increased to 4 percent from 3 percent for the fraction of residential property worth above $1 million but remained unchanged for non-residential assets.

Almost 55 percent of all private home purchases in 2022 were worth a minimum of $1.5 million, while another 15.4 percent were worth at least $3 million, according to data from the Urban Redevelopment Authority.

Christine Sun, who is the senior vice president of research and analytics at OrangeTee & Tie, reported that 39.2 percent of the companies were valued between $1.5 million and $3 million.

Using last year’s data as a guide, she estimated that approximately 50 percent of transactions could be affected by the higher BSD.

In 2022, over 71,1 percent of all new house sales were worth a minimum of $1.5 million, compared to 46.8 percent of all resale transactions.

Ms Sun speculates that the modifications will have a greater impact on the new sales market than on the resale market because of the concentration of new launch condo projects in the city fringe and the prime districts (which account for more than half of this year’s launches).

She stated that wealthy purchasers are unlikely to be intimidated by the higher BSD, therefore there may not be a significant impact on homes in the upper echelons.

In addition, houses valued at $3 million and beyond tend to have unique characteristics, and those priced at $10 million and above are rather uncommon, which will continue to pique investor interest, according to Ms Sun.

Mr Ismail Gafoor, the CEO of PropNex Realty, feels that the announced hike in BSD “builds on the announced rise in rates for property taxes in the 2022 Budget.”

“We do not anticipate this adjustment to have a substantial impact on home sales, as the rise in BSD payment should be reasonable for buyers of properties valued between $1.5 million and $3 million.”

For example, the BSD owed by a purchaser of a $2 million home will increase by $5,000, which isn’t a significant increase for buyers in this price range, he explained.

During Budget 2022, the Singapore government announced that property tax rates would increase over a two-year period beginning in 2023, with harsher increases for luxury and investment homes.

The property tax rate for residential properties that are owner-occupied with an annual value in excess of $30,000 was increased from 5 percent to 23 percent in 2023 and 6 percent to 32 percent in 2024.

This had increased from 4 percent to 16 percent in the past.

For non-owner-occupied properties, including rental homes, the rate increased from 10 to 20 percent to 12 to 36 percent, from 10 to 20 percent.