MND slashed land supply under 2H 2019 GLS programme

The total supply of land in 2H 2019 is the lowest since 1H 2017

The government has cut the supply of private residential units for the second half of this year, under its 2H 2019 Government Land Sales (GLS) programme. The Ministry of National Development (MND) says demand continues to fall after cooling measures were introduced.

While there are fewer units, it says that the supply will be sufficient for Singapore’s housing needs, and that’s because of the ample units in the pipeline in addition to vacant homes currently available.

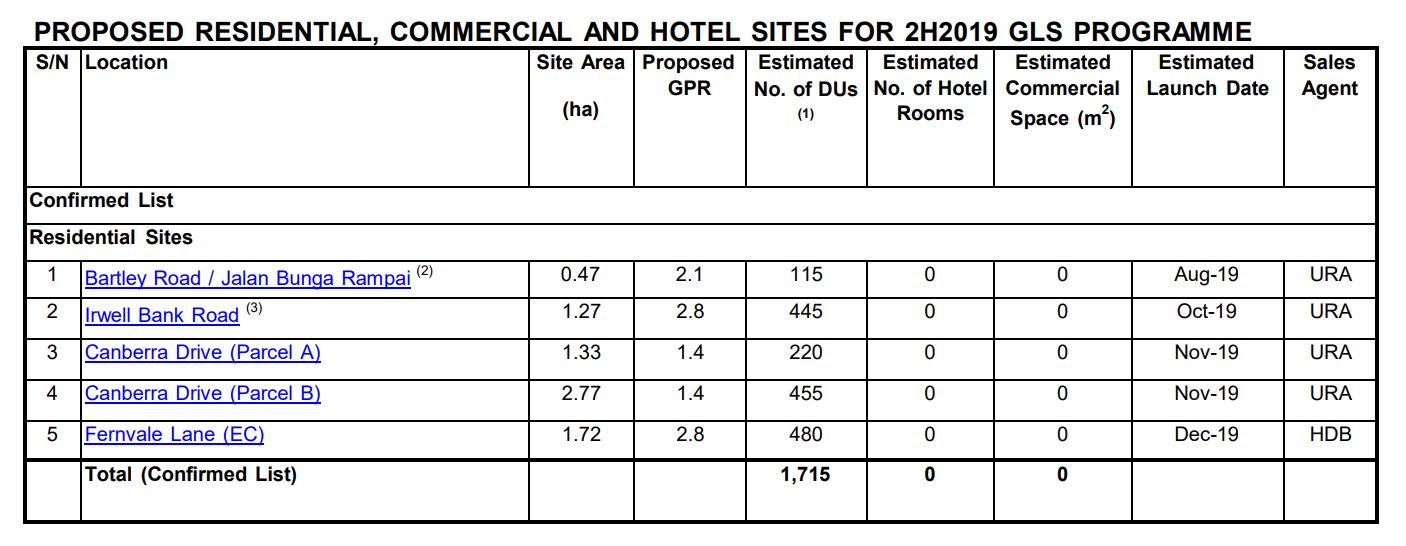

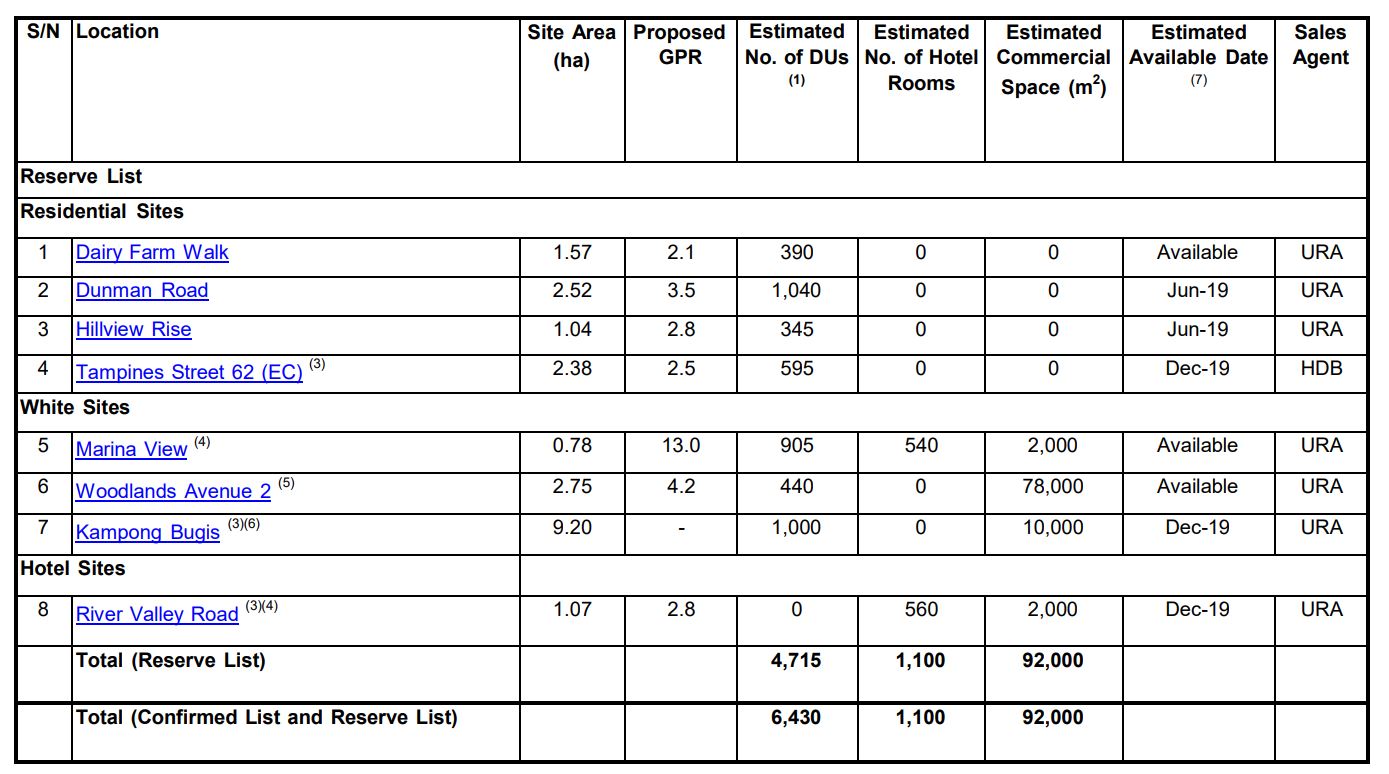

13 sites were released for the second half of this year – 5 on the confirmed list and 8 on the reserve list.

The 5 confirmed private residential sites are located at Bartley Road, at Irwell Bank Road, and 2 at Canberra Drive. There’s also an executive condominium site at Fernvale Lane. Together, these sites can yield about 1,715 private units. That’s nearly 300 fewer than the units released earlier this year.

The Irwell Bank Road GLS site on the 2H 2019 GLS confirmed list has been noted to be the site which could pique the interest of many major property developers due to its location within the prime residential district.

The 1.27-ha site has the potential to yield around 445 units in total and based on the acquisition price of the nearby Jiak Kim Street (now known as Rivière) of $1,733 per square foot per plot ratio (psf ppr), the land price of the Irwell Bank Road site could come up between $1,500 – $1,800 psf ppr.

However, analysts believe that developers will still adopt a wary approach based on sales results from the neighboring new projects – such as Boulevard 88 and Rivière.

It was noted that there’s a smaller supply in the latest round of GLS because nearly 44,000 private homes are in the pipeline – a majority of which remains unsold. That’s not including the 24,000 private homes that are currently vacant.

There are also other factors why the government reduced the supply.

One market watcher noted that the cooling measures introduced in 2018 have actually the objective of cooling down the property market and without these measures, property prices may actually surge at a tremendous pace. Thus he believes that future prices will very much be moderated as compared to what was seen in early 2018.

MND also highlighted a decline in the transaction volume for the 3rd consecutive quarter in Q1 2019. Furthermore, property developers have also moderated their demand for land. Property analysts say buyers may not feel the effects too severely. Instead, developers and the construction sector are the ones under pressure.

Analysts said that most of these new homes have to be sold within five years, otherwise, the property developer will have to bear an additional 25% of its total cost under the Additional Buyers’ Stamp Duty (ABSD) ruling imposed on property developers – which is a significantly hefty sum to most.

As sites on the reserve lists are being launched for sale via a triggering bid, analysts also said that these sites will be appealing to developers who have a strong balance sheet or not bogged down by existing inventory.

Thus, it may give them a significant advantage in terms of acquisition cost as compared to those who are distracted by their own inventory.

MND says it will monitor the property market and adjust the supply from future land sales accordingly.